Our Goal is to Build a $1.3B Global Solution that Improves Container Transportation Efficiency, Reduces Congestion, and Lowers Emissions—We Believe it’s the Greatest Advancement in Port Logistics Since the Invention of the Shipping Container.

Private Investment Offering

The Opportunity is Clear.

Landlocked container ports are now sprawling, multisite complexes processing ever-larger ships. They universally need more efficient terminal connectivity with less environmental and social impact.

Current Strategic Interest From:

Ports in India, Brazil, South Africa, Oman, and the United States, plus Saudi Arabia’s Ministry of Investment, Ministry of Transportation & Logistics.

Ports in Jeddah, Dammam, and Riyadh.

Offering Terms

Minimum Investment: $10,000 USD

Maximum Investment: $10 Million USD

Series Tech Bridge II Preferred Membership Interests

INVESTMENT STRUCTURE

Offering is a $10M portion of a $40M Series A Institutional Investment Round.

Series A ‘Tech Bridge II’ Highlights

Offering Size: $10M (of a $40M Series A)

Valuation: $51.7M pre-money

Investor Terms: Tech Bridge II investors receive the same preferred terms as Series A institutional participants.

Committed Interest:

$15M LOI from global private equity firm Ara Partners

Up to $10M Indication of Interest from CleanNRG / BitCrude

See disclaimer for accredited investor eligibility requirements.

Interested in Discussing this Private Offer?

Reserve some time with Tim Brankin or reach out to tim.brankin@eaglerail.com.

Our current valuation is $51.7M as prescribed by Ara Partners, a global private equity firm with whom EagleRail has a signed investment consideration MOU. These estimates are based on our latest 25-year business model.

Projections. In the event that prospective investors are provided with any projections regarding the future operations of the Company, they should realize that any projections will be subject to numerous assumptions, most of which will not be achieved. Prospective investors should realize that the actual operations of the Company will vary substantially from any estimates the Company may provide from time to time, and there can be no assurances that the projections can be achieved in whole or part, due in substantial part to the risk factors set forth herein as well as the uncertainty of future events. Investment in the Company involves a high degree of risk.

MARKET DISRUPTOR

Invest Alongside the Inventors and Global Patent Holders.

Founded by U.S. inventors of the technology and system concept, two Global Patents protect the EagleRail carrier, overhead transport, and route management systems. We also hold patents in the UK, EU (all main shipping countries), Brazil, India, South Africa, Hong Kong and China, and are pending in other jurisdictions.

Top 3 Reasons to Invest

Massive Global Market & Urgent Need

The $300B+ intermodal container industry is expanding rapidly while facing mounting pressure to reduce congestion, emissions, and inefficiencies. EagleRail addresses these critical challenges and improves port operation KPI’s with faster, smarter, and cleaner horizontal, short-haul transportation. Our customizable solutions can work in all 400+ global seaports, plus thousands of inland operations and rail yards.

Proven Global Interest & Proven Technology

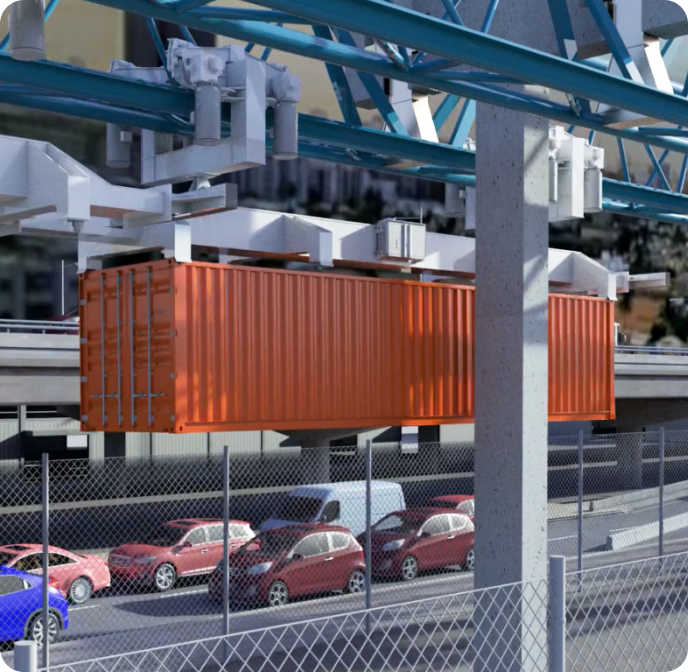

Our overhead conveyance rail technology has attracted attention from major port authorities and logistics leaders worldwide because it utilizes unused airspace and interfaces with all existing container handling equipment. We’ve completed over 100 pre-feasibility studies for ports and rail terminals with 100% customizable track designs that meet current and future transit volume increases. Two Global Patents protect the EagleRail electric carrier, overhead transport, and route management systems.

High-Impact Solution,

Potential High-Return Opportunity

EagleRail delivers strong environmental, economic, and operational ROI. Our regional franchise-like partnerships and 'infrastructure-as-a-service' model are structured to generate recurring revenue. This capital-light expansion model, pairing low-risk technology with efficiency gains, advances global sustainability goals.

I believe EagleRail is addressing one of the core issues that's only going to grow exponentially… with an electrified rail solution that can move the bottleneck away from congested port areas and into interland operations, makes all the sense in the world.

Lars Jensen

Investor, International Port Analyst to the container shipping industry

PROVEN TECHNOLOGY & BENEFITS

Comprehensive Financial Benefits Analysis Proves Overhead Light-Rail Shuttling More Efficient Than Trucks, Even with Dedicated Fly-over Roads.

EagleRail has consulted with most major port complexes on five continents and found most have comparable needs—to improve port KPI efficiencies through faster, smarter, and cleaner horizontal, short-haul transportation. By creating Concept Studies with system designs, OpEx, CapEx, Price-per-Container-Move, and other quantifiable, indirect monetary benefits, we have been able to optimize our technology, pricing, operational, and service models.

Studies and throughput data are based on internal benefit-cost analysis modeling.

Containers Plus Industrial Applications

The 40’ and 20’ container, and all handling equipment, are the same in every global port. In addition to ISO containers, our systems move industrial tanks, racks, and other bulk freight expanding to thousands of potential installations.

Fly-through Inline Scanning and Customs Inspections

Cross-border & Military Support

COMMERCIAL, SOCIAL & ENVIRONMENTAL BENEFITS

Holistic Benefits v. Diesel Trucks are Proven and Verified Using EPA and DOT Data and Validated by Ara Partners.

Head-to-head there’s no comparison.

This study, endorsed by Ara Partners, a global private equity firm, compared EagleRail to diesel trucks, measuring the factors of a fully loaded, 40-ft. container traveling along a 10-mile journey.

COMMERCIAL PARTNERSHIPS

Seamless Integration with Localized Operations

Creating local Joint Ventures (JVs) with regional Operating Partners allows us to enter markets quickly, gain local operating licenses and expertise, keep various supply and development expenses in-country, and have better access to Public-Private Partnership (PPP) infrastructure development capital. It also allows EagleRail to grow the global company at a faster rate with various streams of income from each of the regional companies and projects.

Global solutions work regionally and integrate with all local port layouts, commercial terms, and throughput plans.

Our per-move delivery fees typically match or beat trucking fees. EagleRail delivery provides more valuable data with less wait time, and uses less energy, and lessens road congestion.

Eagle-i scheduling and tracking software integrates with a port’s TOS on one end, and the rail, warehouse, and trucking software on the other. It manages delivery destinations, timing, billing, and even bill of lading (BOL) information. All trackable in real time!

FOUNDING TEAM

Leadership Connecting All Junctions.

Port, rail, intermodal technology and planning experts—plus—engineering design, infrastructure build and finance leadership.

The EagleRail team is a collective of subject matter experts spanning logistics, executive management, and marketing at the highest levels. Their combined careers have driven billions in revenue growth and personally reached major acquisition milestones.

Invest alongside the founder with a track record of growing through acquisitions, leading thousands of employees, and successfully exiting.

MIKE WYCHOCKI

Founder & CMO

Director, lead investor, and majority owner. 30+ years of partner- and owner-level marketing services experience with emphasis on external partner development and internal executive leadership.

TIM BRANKIN

VP New Business & Communications

25+ years of management experience in the fintech and financial industries, including marketing, sales, and communications.

JOHN ELLIOTT

Executive Chairman, ER Logix

Public and private sector executive leading infrastructure, finance, and industrial development businesses. Serves as CEO of Sitelogx and Caplogx, providing development and investment banking services to ports and railroads across North America.

KEVIN RUSSELL

Chief Technical Officer

35 years in port automation and container handling equipment. Electrical Engineer and recognized global expert in power, controls, and communications for port equipment. Works closely with the CTO and leads EagleRail digital simulations.

DR. SCOTT HARPER

SVP Market Dev. & Financial Analysis

PhD in Business Ethics. Chicago Booth MBA. 30+ years of senior management experience within Finance, Operations, and Manufacturing, including software development and government relationships.

DR. SANIA IRWIN

SVP Systems Engineering & Impact

PhD in Computer Engineering. Electrical and Industrial Engineer with 25+ years in Tech/Fortune 500 technological systems management. Serves as the current head of ESG and Impact.

JIM GUTTOSCH

VP Operations & General Manager

35+ years in large organizations and operations management, including basic financial reporting, office and outside vendor management.

ROBERT ALGER, PE

Board Director

President LSTK at AtkinsRéalis, the largest EPC company in Europe and Canada. 40+ years of experience in construction.

CAPT. RAJESH MEHROTRA

Board Director

CEO of Arkem Marine. Founder and investor with executive expertise in the creation of global maritime and port infrastructure projects spanning multiple industry verticals.

GIANFRANCO CATRINI

Board Director

Director Corporate Development, WeBuild Group. Oxford, Harvard MBA with 30+ years of experience in the infrastructure and construction industry, leading operations of major billion-dollar international EPC firms.

IBRAHIM ALSAEED

Board Advisor

Special Advisor for the GCC Region with 30+ years in the maritime and financial industries. Former director of the Saudi Arabian Ministry of Investment.

BILL HAMLIN

Board Advisor

President of Gray Wolf Advisory Group. 35+ years of global intermodal industry experience, including ITS ConGlobal, Horizon Lines, APL, and Sealand Services.

MARK NICHOLS

Board Advisor

Washington D.C. Gov’t Affairs Advisor. Diverse career in European affairs, energy, infrastructure, commodities, emerging markets, and national security. Worked at the U.S. Department of State and the U.S. Agency for International Development (USAID).

MIKE SCIMECA

Board Advisor

35 years of manufacturing engineering and process experience, and has led large teams at office and project sites as EVP of Ghafari Engineering.

INDUSTRY REPORT

Consolidated 3-Agent AI Industry Report

Focusing on current projections from major financial institutions and respected financial analysts, we created this global logistics outlook report. Deep research models with web search functionality generated outputs from ClaudeAI, DeepSeek-R1, and Llama-3 with the same instruction. To cross-check any inconsistencies, ClaudeAI merged sections, researched sources again, and prepared this unbiased industry analysis.

GLOBAL UPDATES

The Global Container Industry is Embracing Horizontal Automation, and We Have Several Key Study Engagements in Progress.

Saudi Arabia

EagleRail executives held 10 days of in-person meetings in July with key organizations in Saudi Arabia. Discussions included potential projects, private investments, economic benefits analysis, operating and development partnerships, and placement of our second-generation prototype.

EagleRail met with Saudi government agencies, including the Ministry of Investment, Ministry of Transportation and Logistics, National Industrial Development and Logistics Program, and Transportation General Authority. We held project meetings with LogiPoint Logistics in Jeddah, and King Abdullah Port and King Abdullah Economic City. Strategic Partnership meetings were held with a potential joint venture partner to co-develop projects throughout the Gulf Cooperating Council (GCC) region.

Finally, we met with three top steel and fabrication providers regarding building EagleRail track and truss components in Saudi Arabia for projects globally.

Brazil

A four-person EagleRail team traveled to Brazil for a week-long tour starting in São Paulo, to advance the Port studies begun with Porto Itapoá and Porto Navegantes (Portonave), two of the largest Brazilian ports by TEU volume.

We are also proposing a study for the Port of Itajaí in the State of Santa Catarina. It will study the feasibility of relocating truck traffic to the outskirts of the city and delivering containers into the port, thereby minimizing traffic congestion downtown and eliminating diesel pollution. In northern Brazil, we're talking with the Port of Pecém to potentially connect with a newly commissioned rail, and hope to have study results in place by the time the rail terminal is completed. We're reviewing a small system in the Port of Santos, the largest port in Brazil, to connect one of the terminals to a rail line.

We are working to strengthen our capacities by searching for a Brazilian joint venture partner. At the moment, we are exploring partnerships with a rail operator, a logistics provider, and a diversified industrial holding company.

Project Development MOU in Oman

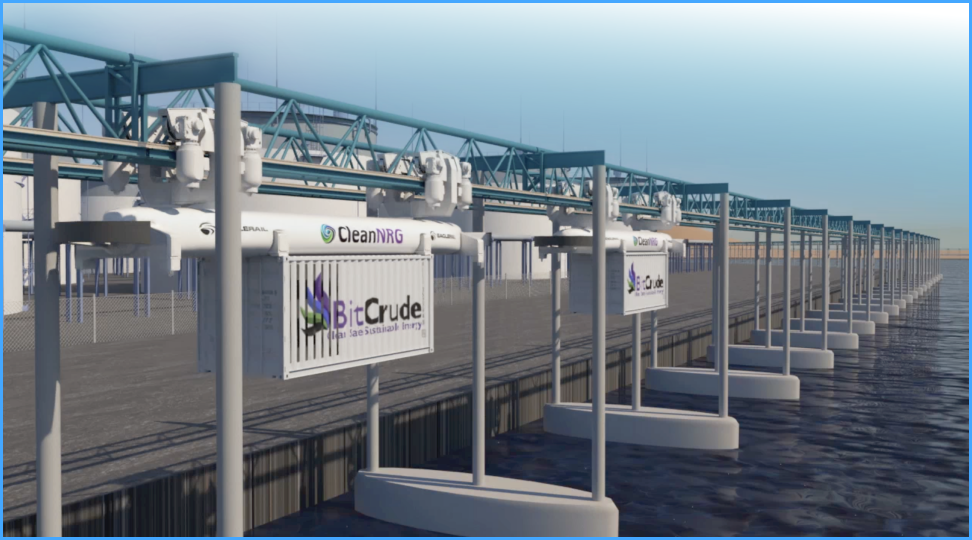

We have signed an MOU for the construction of a 7.9km $482M EagleRail system to convey 1,300,000+ 20-foot shipping containers annually, which is equivalent to 19M+ Barrels, between the port of Duqm, Oman and a new BitCrude Energy Hub refinery. This could be one of the first two development projects for the Saudi Joint venture, and we are presently negotiating the development agreement for Q4 2025 with detailed design to begin by Q1 2026, and with fabrication planned for late 2026.

Watch the 24/7 port conveyance ‘pipeline’ enabled by EagleRail!

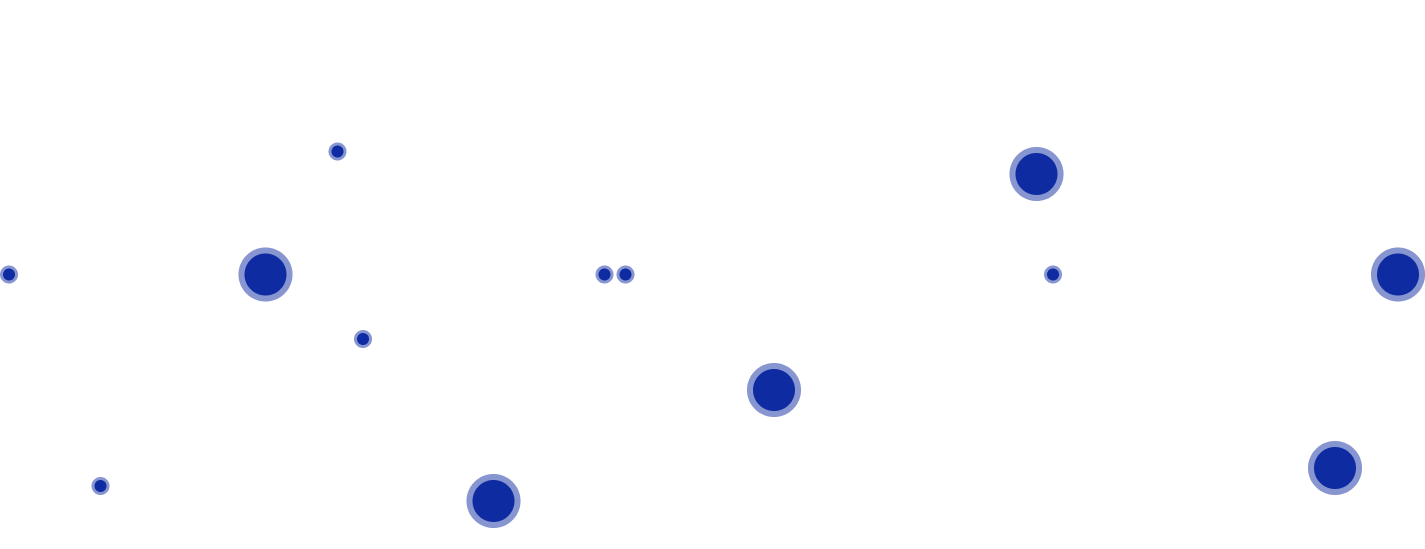

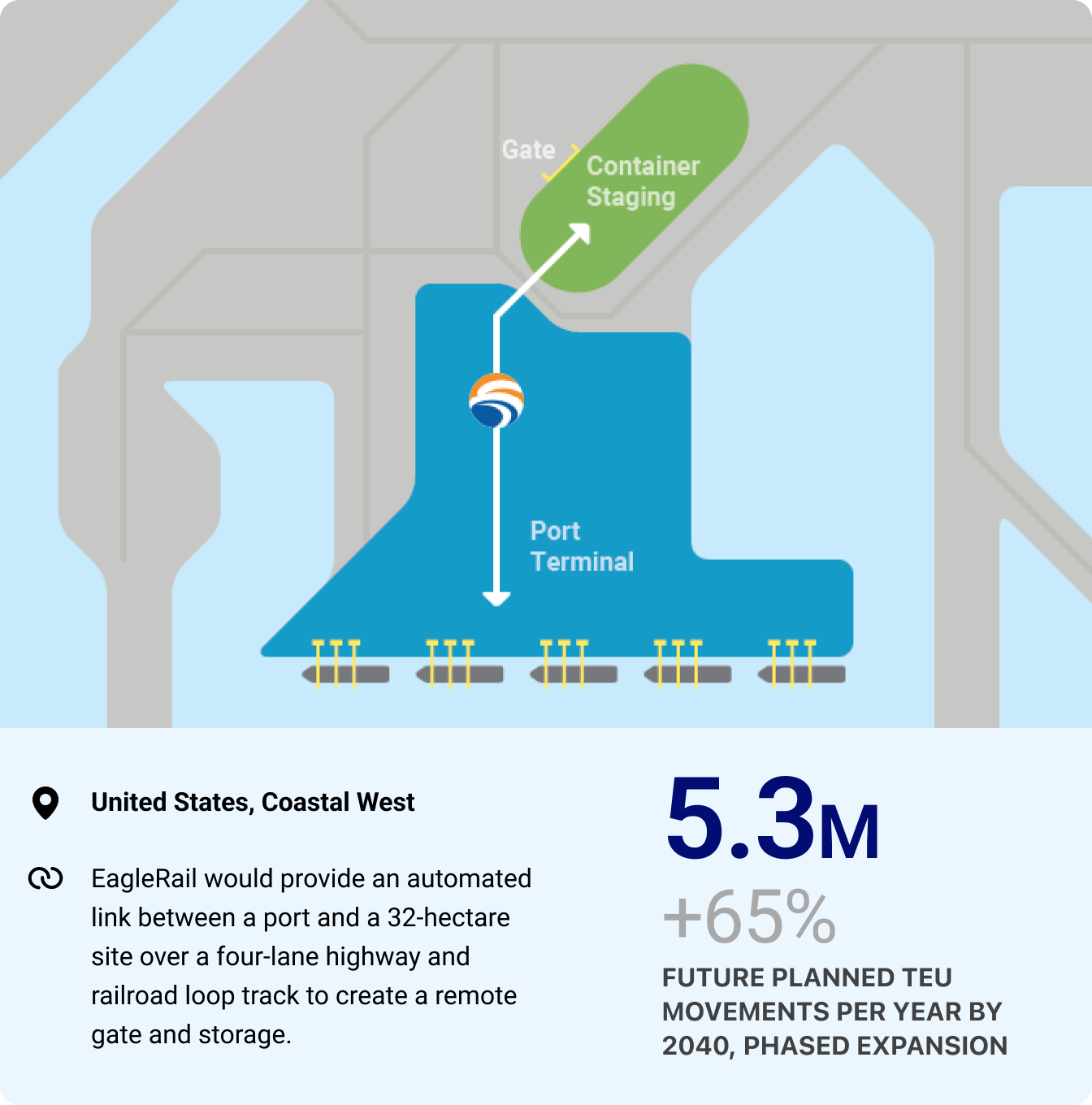

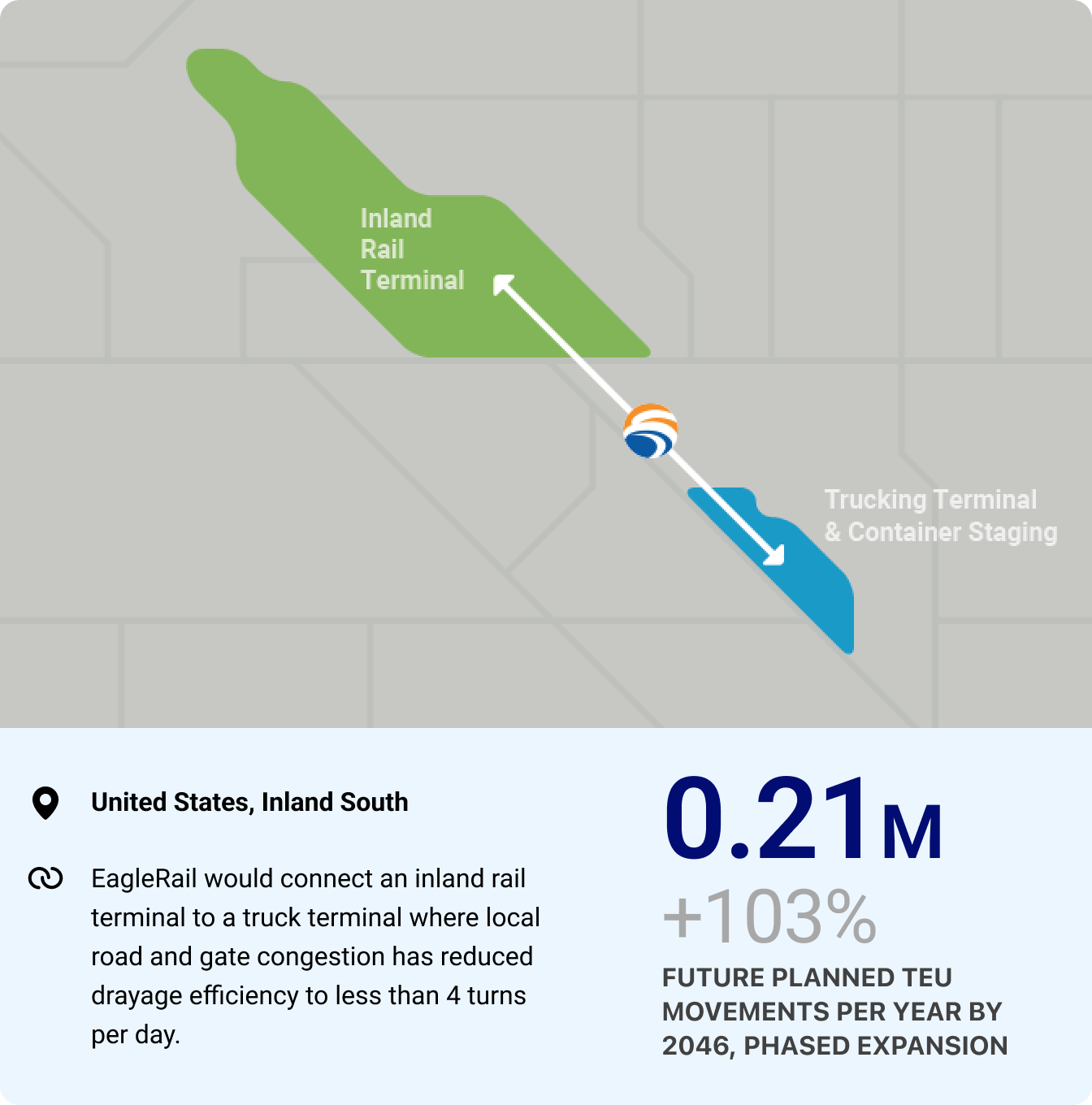

United States

We’ve restarted conversations regarding pre-feasibility studies with the Port of Oakland and a potential new study with the Port of Philadelphia (PhilaPort). If these move to the project stage, we have a pre-commitment MOU from Ara Partners, a global private equity firm, to fund projects up to $100M USD in the US, EU, UK, or Canada.

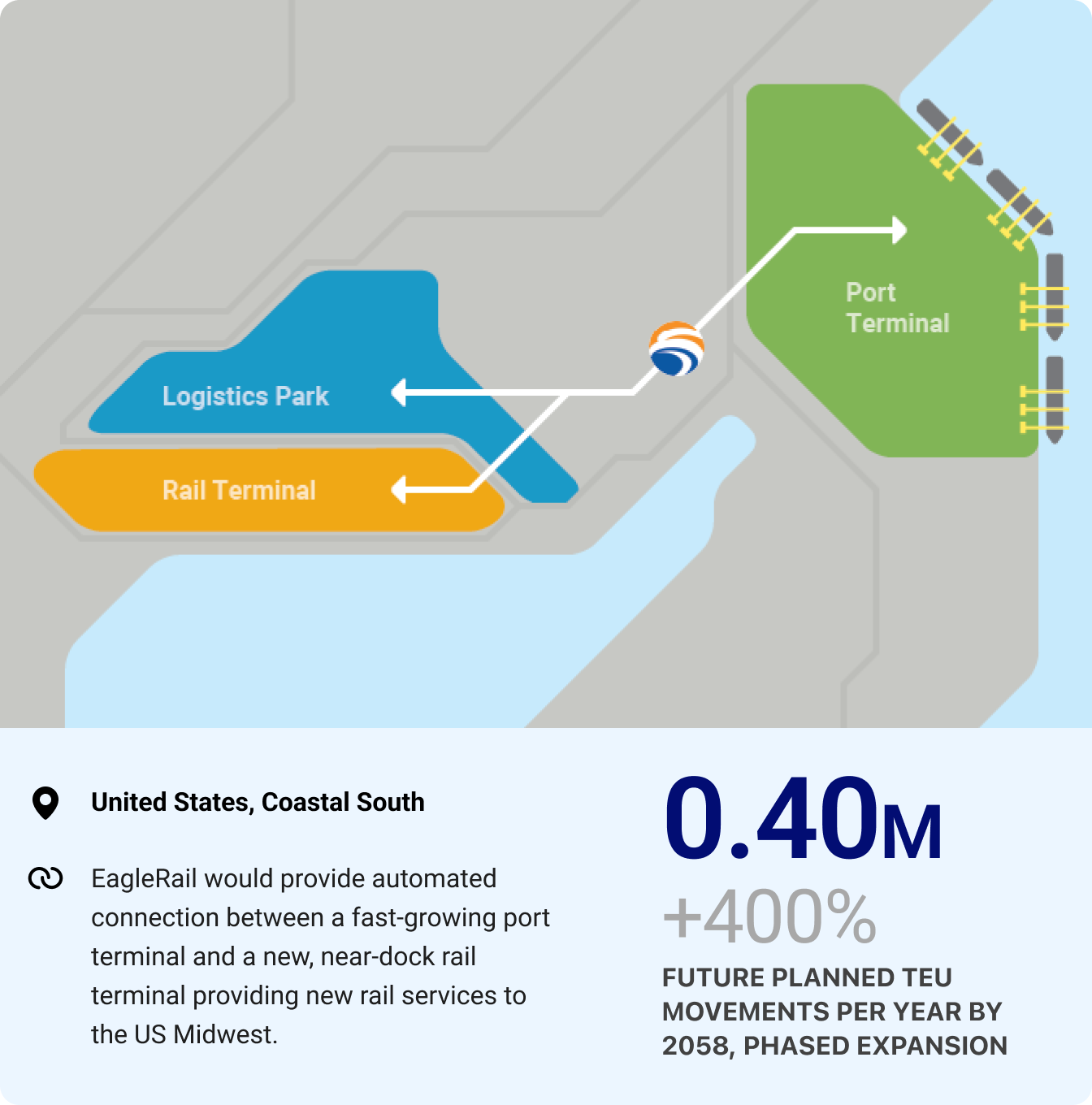

Mundra, India

We are in discussions with a large port operator at the Mundra South Port in a 3-phase expansion study connecting two export/import yards, rail yards, and inter-terminal transfers. If we move forward, this advanced, horizontal automation scenario would connect multiple terminals with remote truck gates and near-dock rail.

Cape Town, South Africa

Successful conversations with the Port of Cape Town operations team are advancing our preliminary design and benefits analysis to support next-stage discussions with Transnet Rail and Port authorities.

Price Waterhouse Coopers’ Study Validates EagleRail Efficiency in Bangladesh

Recent Intermodal Shipping News, Trade Conference Highlights, and Publication Reach.

Saudi Rail Conference Highlights

Crane Daddy: Reimagining Global Ports

TOC Europe 2025 Pics

PRIVATE INVESTMENT OFFERING

This is the first time EagleRail Units have been privately available as a Regulation D 506(c) offering.

DISCLAIMER

The communications found on this website (the “Website”) are made by or on behalf of ER Logix LLC (the “Company”), shall not constitute an offer or solicitation to sell securities in any jurisdiction where such offer or solicitation does not comply with state, local or foreign laws or regulations.

The Securities will not be registered under the Securities Act in reliance upon the exemption from registration provided by Sections 3(b) and/or 4(2) of the Securities Act and Rule 506(c) promulgated under Regulation D.

The Company expressly reserves the right to reject any indication of interest or subscription agreement from a potential investor in any jurisdiction whatsoever where the offer or solicitation does not comply with applicable laws or regulations or for any other reason.

The material on this Website is for informational purposes only and is not intended for any other use. This Website is not an offering memorandum or prospectus and should not be treated as offering material of any sort. The Website is intended to be of general interest only and does not constitute or set forth professional opinions or advice. The information on this Website is speculative and may or may not be accurate. Actual information and results may differ materially from those stated on this Website. Past performance is no guarantee of future results. We urge you to read the Risk Factors provided below.

Private placements are not suitable for all investors. Private placement securities are speculative, illiquid and carry a high degree of risk, including the loss of the entire investment.

The Company and its respective affiliates make no representations or warranties which respect to the accuracy of the whole or any part of this Website and disclaim all such representations and warranties. Some of the data and industry information used in the preparation of this Website (and on which the Website is based) was published by third-party sources and has not been independently verified, validated, or audited. Neither the Company nor its respective principals, employees, or agents shall be liable to any user of this Website or to any other person or entity for the truthfulness or accuracy of information contained on this Website or for any errors or omissions in its content, regardless of the cause of such inaccuracy, error, or omission. Furthermore, the Company, their affiliates, principals, employees, or agents accept no liability and disclaim all responsibility for the consequences of any user of this Website or anyone else acting, or refraining to act, in reliance on the information contained on this Website or for any decision based on it, or for any actual, consequential, special, incidental, or punitive damages to any person or entity for any matter relating to this Website even if advised of the possibility of such damages.

Risk Factors

Forward Looking Statements

This document contains certain statements that are “Forward Looking Statements” within the meaning of Section 27A and Section 21E of the Securities Exchange Act of 1934 (Exchange Act), as well as the Private Securities Litigation Reform Act of 1995 (Reform Act). Actual results may differ materially from those projected as a result of certain risks and uncertainties. These Forward Looking Statements are made only as of the date set forth on the cover page of this form of Subscription Agreement (the “Offering Date”), and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Although the Company believes the expectations reflected in Forward Looking Statements are reasonable, there can be no assurances they will prove to be accurate. Generally, these statements relate to business plan strategies, anticipated strategies, levels of capital expenditures in current and future operations, liquidity and anticipated capital financing needed to affect the business plan. All phases of the Company’s operations are subject to uncertainties, risks and other influences, many of which are outside the Company’s control of the Company and unforeseeable with any degree of accuracy. Actual results may differ materially from those described in such “Forward Looking Statements.” In light of the significant uncertainties inherent in the “Forward Looking Statements” made in the materials provided to investors, the inclusion of such statements should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

Full disclaimer can be found on the Investor Subscription Page.